S2K Commerce - Products Dropdown

S2K Commerce - Products Dropdown

S2K Commerce - Order Entry

S2K Commerce - Order Entry

Home

>

Office

>

Forms, Recordkeeping & Reference Materials

>

Forms

> Four-Part 1099-NEC Continuous Tax Forms, 8.5 x 11, 2/Page, 24/Pack

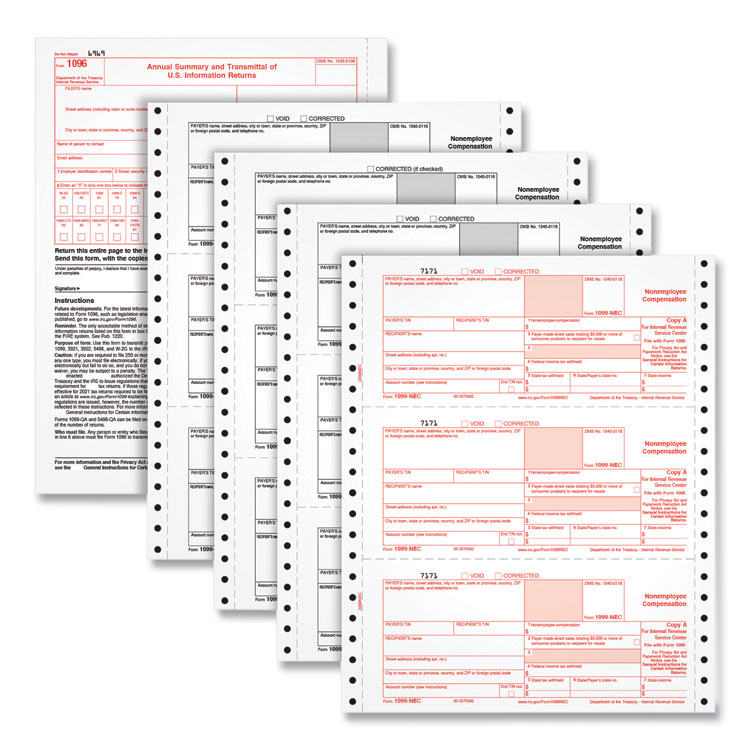

Four-Part 1099-NEC Continuous Tax Forms, 8.5 x 11, 2/Page, 24/Pack

Item #:

TOP2299NEC-ES

Available: In Stock

TOPS™ 4-Part 1099-NEC Continuous Tax Forms

- This TOPS™ forms pack provides 4-part 1099-NEC continuous feed forms for dot-matrix printers and 1096 summary forms.

- Use Form 1099-NEC to record nonemployee compensation to the IRS and recipients.

- Acid-free paper and heat-resistant inks help you produce legible, smudge-free, archival-safe records.

- Print 3-up on micro perforated sheets; includes IRS scannable red ink pages with copies A, State, B and C.

- Meets IRS specifications; accounting software and QuickBooks compatible.

- The 1099-NEC is due to the IRS and your recipients by January 31, 2022.

19.64

PACK

Quantity:

TOPS™ 1099-NEC Tax Forms report nonemployee compensation paid to your independent contractors. This year, the IRS has reduced the size of the NEC to fit 3 forms per sheet. Our acid-free paper and heat-resistant inks help you produce smudge-free, archival-safe tax forms. Copy A and 1096 sheets have the scannable red ink required by the IRS for paper filing. Form Size: 8.5 x 11; Forms Per Page: 2; Form Quantity: 24; Sheet Size: 8.5 x 11.

Forms

Form Quantity

24

Form Size

8.5 x 11

Forms Per Page

2

Global Product Type

Forms-Tax

Paper Color(s)

White

Post-Consumer Recycled Content Percent

0%

Pre-Consumer Recycled Content Percent

0%

Principal Heading(s)

1099-NEC

Printer Compatibility

Dot Matrix

Sheet Size

8.5 x 11

Total Recycled Content Percent

0%

UPC

025932229121

Need Item In Bulk?

Become a Sigma Direct Customer, negotiated pricing and inventory management, with payment terms that suit your budget needs. Our customer services make the process quick and easy. Call us at (800) 264-1661.

CONTACT US